1:30 PM - 3:00 PM Central

Chamber Event

Training

Online Event

Continuing Education Credit

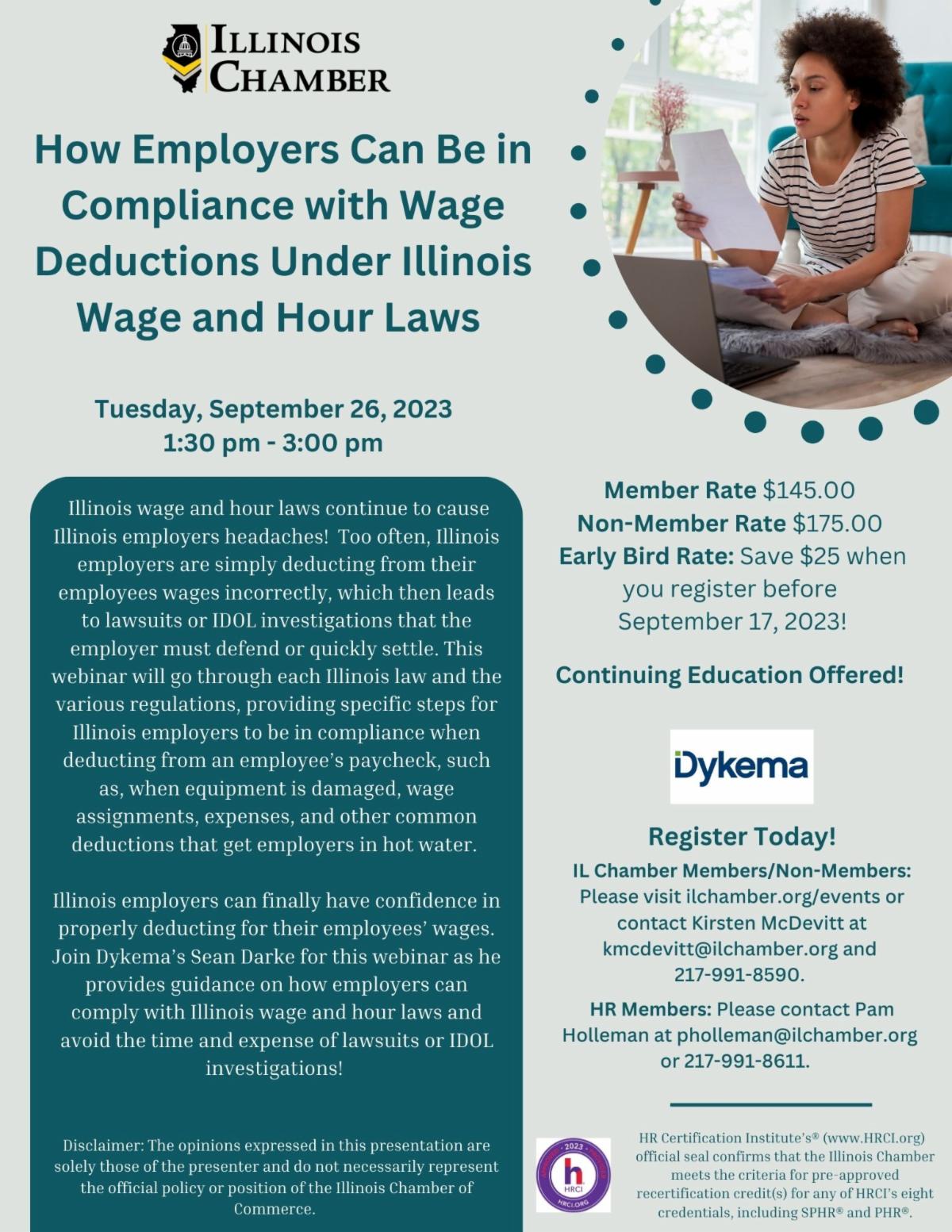

Illinois wage and hour laws continue to cause Illinois employers headaches!Too often, Illinois employers are simply deducting from their employees wages incorrectly, which then leads to lawsuits or IDOL investigations that the employer must defend or quickly settle. This webinar will go through each Illinois law and the various regulations, providing specific steps for Illinois employers to be in compliance when deducting from an employee’s paycheck, such as, when equipment is damaged, wage assignments, expenses, and other common deductions that get employers in hot water. Illinois employers can finally have confidence in properly deducting for their employees’ wages. Join Dykema’s Sean Darke for this webinar as he provides guidance on how employers can comply with Illinois wage and hour laws and avoid the time and expense of lawsuits or IDOL investigations!

Continuing Education Offered: 1.50 HRCI and SHRM credits, 1.50 CLE per attendee request prior to event, and 1.50 HR & Management/Supervision Compliance Certificate Credits. HR Certification Institute’s® (www.HRCI.org) official seal confirms that the Illinois Chamber meets the criteria for pre-approved recertification credit(s) for any of HRCI’s eight credentials, including SPHR® and PHR®.

(phone: 217-991-8590)